So far, we have seen digital evolutions of the banking sector in significant ways. That is deeper into how the banking sector leverages competitive advantages by bringing tech closer and how digital operations can help in establishing a compelling customer experience. However, with another wave of digital innovation, integrating IoT in the banking sector gained prominence.

This next-gen technology enables the banking sector to create a connected ecosystem by offering a platform to form the seamless interconnection between networks, sensors, devices, and other entities. The Internet of Things in banking industry has capabilities to bring revolution in numerous aspects, whether it’s about maintaining uninterrupted data flow or getting insight into progressive operations.

So let’s see how IoT is contributing toward creating an interconnected ecosystem and why the integration of IoT in banking sector is a smart choice for any financial or banking industry.

IoT in Banking Sector

IoT represents the growing sum of smart devices or physical systems that are directly connected to the internet or with other entities via the internet. It also includes everything associated with the term smart such as Smart cars, Smart buildings, Smart manufacturing, or Smart banking. Therefore, the SMART word completely correlates with IoT-enabled solutions.

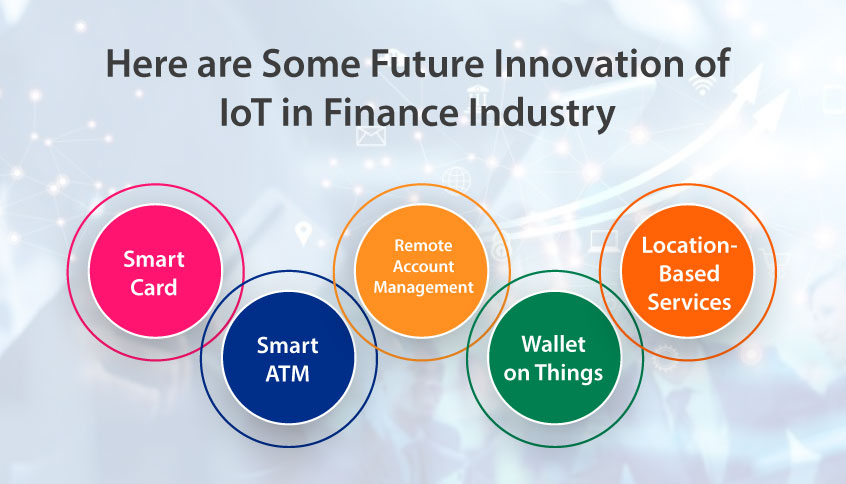

Ultimately, the banking industry can embark on the journey to achieve Smart operations and processes only with IoT. Driving innovation or reimagining the future of the banking sector, IoT has a noticeable impact and contribution. Let’s see some future innovations of IoT in banking Industry. Also, by embarking on the smart journey what new your banking sector will undergo through.

Here are Some Future Innovation of IoT in Finance Industry

Smart Card:

The “Smart” card concept has already talked of the towns that are generated by IoT. This smart card will empower citizens to utilise and perform specific tasks such as payment without any need for a physical card or chips. This innovation will create convenience for users and provide a more secure way to pay digitally.

Smart ATM:

Smart ATM is about strengthening the power or capabilities of traditional ATMs and enhancing their functionalities through IoT incorporation. Sensors or other IoT devices help banks to gather ATM data, including its usage, and customer behaviour which helps the banking industry to improve customer experience.

Remote Account Management:

IoT-enabled internet devices like smartwatches, smartphones and smart speakers empower customers to manage their bank account from a remote location without entering the bank premise. Activities including checking balance, transferring funds, paying bills and other. Thus, by providing customers control over their finance process through remote locations which ultimately reduce the number of physical bank branches.

Wallet on Things:

The term “Wallet on Things” (WoT) refers to the integration of digital wallets with the Internet of Things (IoT) devices. With this feature, IoT devices can be used to make payments and financial transfers directly from a bank account. For instance, an IoT-enabled fridge can automatically order groceries and charge the cost to the user’s digital wallet. Transactions using WoT technology are secure, transparent, and immutable thanks to blockchain technology.

Location-Based Services:

Location-based services (LBS) use data from IoT devices, such as GPS and Wi-Fi, to provide information or services based on a user’s location. In the context of baking, LBS could be used to provide information on nearby bakeries or recipes based on a user’s location. Additionally, LBS could be used to track the location of delivery vehicles and provide real-time updates to customers on the status of their orders.

Concluding Lines on IoT in Banking

Ultimately, integration of the Internet of Things in Banking Industry can revolutionise the way financial services are delivered to customers. With the use of IoT-enabled devices, banking can become more convenient, secure, and personalised. Aside from detecting and preventing fraud, IoT devices can also enhance the efficiency of banking operations. As the number of IoT devices and their capabilities continue to increase, the possibilities for IoT in banking and finance industry will only continue to grow.

Are you looking to enhance the efficiency of your baking process through digitalization? IoT is the best tech solution for you. Partner with us, i.e., Rejig Digital to leverage the benefits of an IoT-enabled solution and integrate it according to your organisation’s needs.