IoT in Banking and Finance: A Look at the Transformative Power of Connected Devices

Stage Rejigdigital

The banking and financial sector perceives the Internet of Things (IoT) as a major game-changer. IoT in banking and finance is a highly promising emerging technology that facilitates networks of interconnected devices, such as sensors, cameras, and smart gadgets. These devices simplify various tasks, such as real-time data collection, which is then transferred to the cloud for processing and analysis. This technology also permits devices to respond to events in real time, enabling automation integration in various sectors, such as banking, finance, and supply chain management. BFSI companies leverage IoT solutions to enhance their operational efficiency, transaction security, and customer experience.

According to Verified Market Research, IoT in banking and finance is anticipated to grow USD 30,925 Million by 2030 with a CAGR of 50.10%.

Further, we’ll delve into how the banking and finance industry is undergoing a radical transformation through the implementation of IoT solutions.

How IoT Facilitates Banking and Finance

Billions of interconnected devices form a smart network of systems that share data through the cloud which impacts the banking and finance businesses and their respective customer base. When customers access financial data through smart devices, banks gain real-time, comprehensive information about their finances. This data is seamlessly shared among millions of devices between the customer and the bank which enables banks to anticipate customer needs and offer customised solutions and advice to support smart financial decision-making. Thus, the emergence of IoT in the banking and finance industry can be a transformative technology for enhancing customer loyalty and driving business growth for banks.

Moreover, banks can now engage and communicate with customers regularly, offering advice and rewards beyond financial services, such as suggesting positive lifestyle habits. These efforts to connect with customers in a variety of ways foster a sense of loyalty and trust for banking and finance businesses.

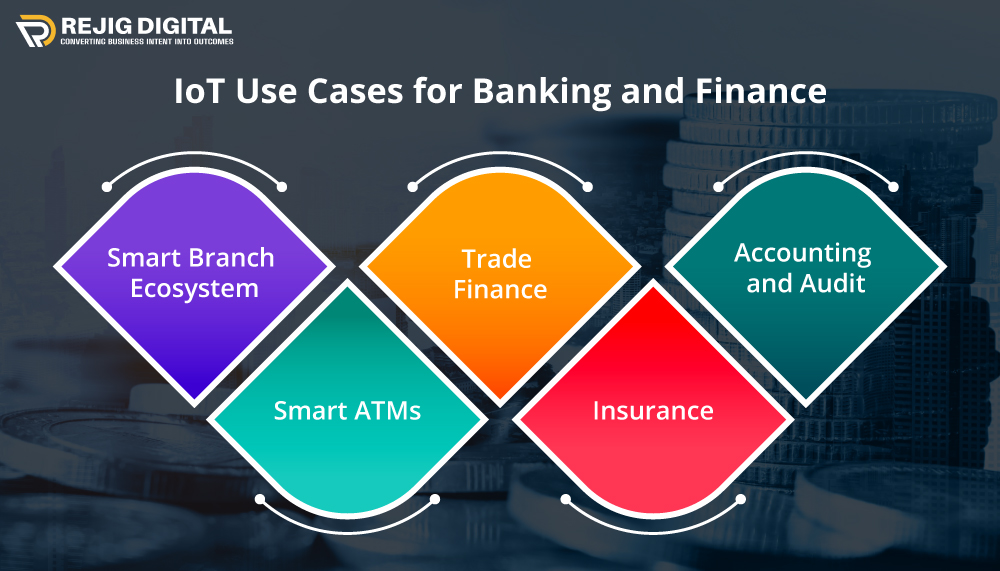

IoT Use Cases for Banking and Finance

The IoT is rapidly gaining momentum in the banking and finance industry, with numerous use cases emerging to improve the customer experience and operational efficiency.

-

Smart Branch Ecosystem

IoT-powered smart workspaces are rapidly increasing among banking and finance businesses. Such a workspace allows businesses to offer customised customer experiences during branch visits through features such as queue monitoring, reduced waiting times, and directing customers to alternative counters.

Banks can enhance their workflow and minimise staff involvement by sharing real-time customer and workspace data. For instance, many businesses are using voice assistants. With IoT in the banking sector, businesses can leverage voice recognition to learn how customers interact with the environment.

-

Smart ATMs

With IoT-connected ATMs, banks can track customers’ activities by collecting data on atmospheric parameters such as room temperature, light, and motion. These connected ATMs are equipped with self-aware technology that adapts to demand and minimises energy consumption by reducing air conditioning and electric lighting when the location is unoccupied or free of high traffic.

Furthermore, the internal sensors constantly monitor the machines, safeguarding against security breaches, such as skimming devices or fraud caused by faulty card readers or a lack of money.

-

Trade Finance

Trade financing banks can use IoT technology to automate their operations and enhance fraud detection. The advanced banking IoT solutions provide insights into every aspect of a trade’s life which helps banks to make informed decisions with real-time data rather than making assumptions.

This approach enables banking and finance businesses to boost efficiency and explore new ways to scale up their finances while simultaneously increasing transparency among company inventories, such as the types of assets stored at each location.

-

Insurance

Insurance is the most significant aspect of utilising IoT in the finance industry. Integrating IoT-enabled devices allows insurers to monitor insured objects and gain insights into their state. Hence, these devices can alert insurers about any irregularities which require reinsurance.

-

Accounting and Audit

IoT allows automatic communication between clients’ payment systems and CPA software which eliminates the need for tedious data entry and manual handling. Accountants can access real-time financial information and gain accurate insights into a company’s operations which allows them to provide better services.

IoT also promotes transparency in accounting and auditing by enabling CPAs to remotely monitor transactions without the risk of errors or fraud. It is one of the significant improvements in the banking and financial domain which is made possible only by IoT.

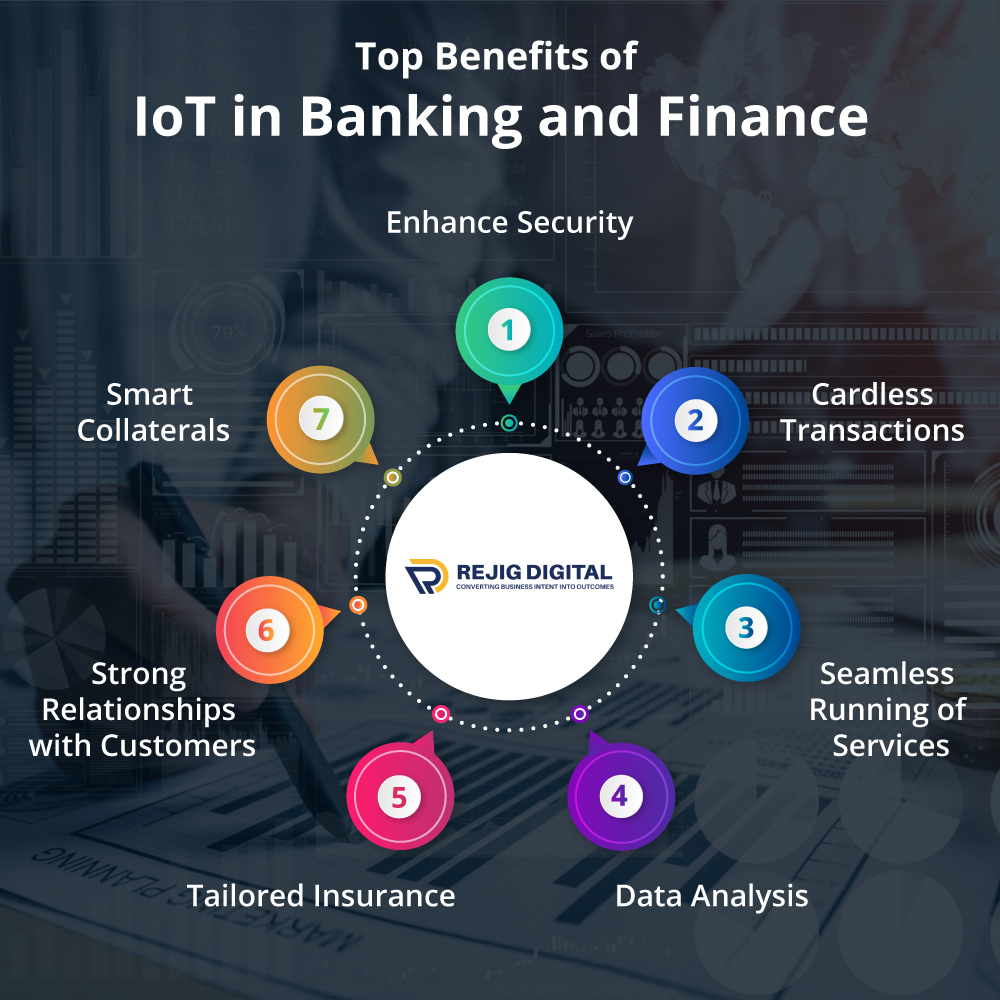

Top Benefits of IoT in Banking and Finance

The IoT in banking and finance is increasingly being adopted owing to its many benefits. Some of the key benefits of IoT in this industry include:

-

Enhance Security

Security is the most important aspect of every financial industry and also an important parameter for the success of this business. Fortunately, IoT has proven to be a valuable tool in the banking sector for detecting and preventing fraud beforehand before it gets too late. By leveraging IoT technology, the financial sector can locate and identify the devices used in finance-based crimes which can further reduce the rate of such mishappenings.

-

Cardless Transactions

Current IoT-based banking applications have credit and debit card synchronisation, which enables users to make contactless payments using their phones that simplify transactions. This benefit has been particularly useful during the COVID-19 pandemic, as it has helped maintain hygiene in crowded places such as shops and public transport.

-

Seamless Running of Services

The IoT empowers banks and financial organisations to detect and resolve service issues proactively before they escalate into more significant problems. By utilising IoT in banking and finance, businesses can track customer behaviour, previous transactions, and any unusual activity in bank accounts.

-

Strong Relationships with Customers

The implementation of IoT technology within the banking sector can help financial institutions in cultivating positive customer relationships and offering superior customer experiences. In addition, IoT can allow banks to offer efficient services that fulfil the diverse needs of their clients.

-

Data Analysis

Integrating with mobile applications and digital sensors, IoT facilitates the rapid collection of data for banks and other financial institutions. This data is analysed to gain insights into customer behaviour which enables these organizations to make better decisions that ultimately benefit their clients in the long term.

-

Tailored Insurance

Insurance companies come up with devices that connect to a car’s on-board diagnostic port, facilitating the transmission of driving behaviour data to the company. This data facilitates the offering of discounts based on driving behaviour and allows for customised insurance policies that consider driving habits, engine health, and wear and tear on the vehicle. Moreover, the data obtained can provide insurance companies with valuable insights into the likelihood of accidents in specific regions, thereby enabling them to price policies accordingly.

-

Smart Collaterals

The entire process of collaterals is transformed through the utilisation of digital identity and IoT technology. With the help of connected assets, the financing request and transfer of asset ownership can be automated and completed digitally in minimal time which allows the bank to immediately issue the loan while keeping an eye on the collateral’s real-time status without the need to take physical custody of it. In case of default on payment, the borrower’s collateral, such as a car, can be remotely disabled until payment is made, and the collateral’s condition can also be monitored.

Wrapping Up

The rise in device usage among bank customers has led to a corresponding increase in the utilisation of IoT data by banks. With IoT in banking and finance, the industry continues to undergo a transformation, and the methods of banking are becoming smarter and more sophisticated. Banks that provide personalised customer service often experience higher customer retention rates and profitability. In addition to Big Data, the emergence of IoT is another boon that can facilitate the evolution of banks and customer service, making it more seamless and beneficial.